1st Quarter Investment Update

It has been a turbulent start to the year with pronounced volatility as financial markets worldwide grapple with uncertainty around the direction of U.S. trade policy, and the potential impact to U.S. economic growth and inflation. Year-to-date, as of March 31st, US equities – as represented by the S&P 500 are down -4.3%, while U.S. bonds - as represented by the Barclay’s US Aggregate gained +2.8% and Global non-US equities (MSCI AC WldxUS IMI) are up +4.6%.

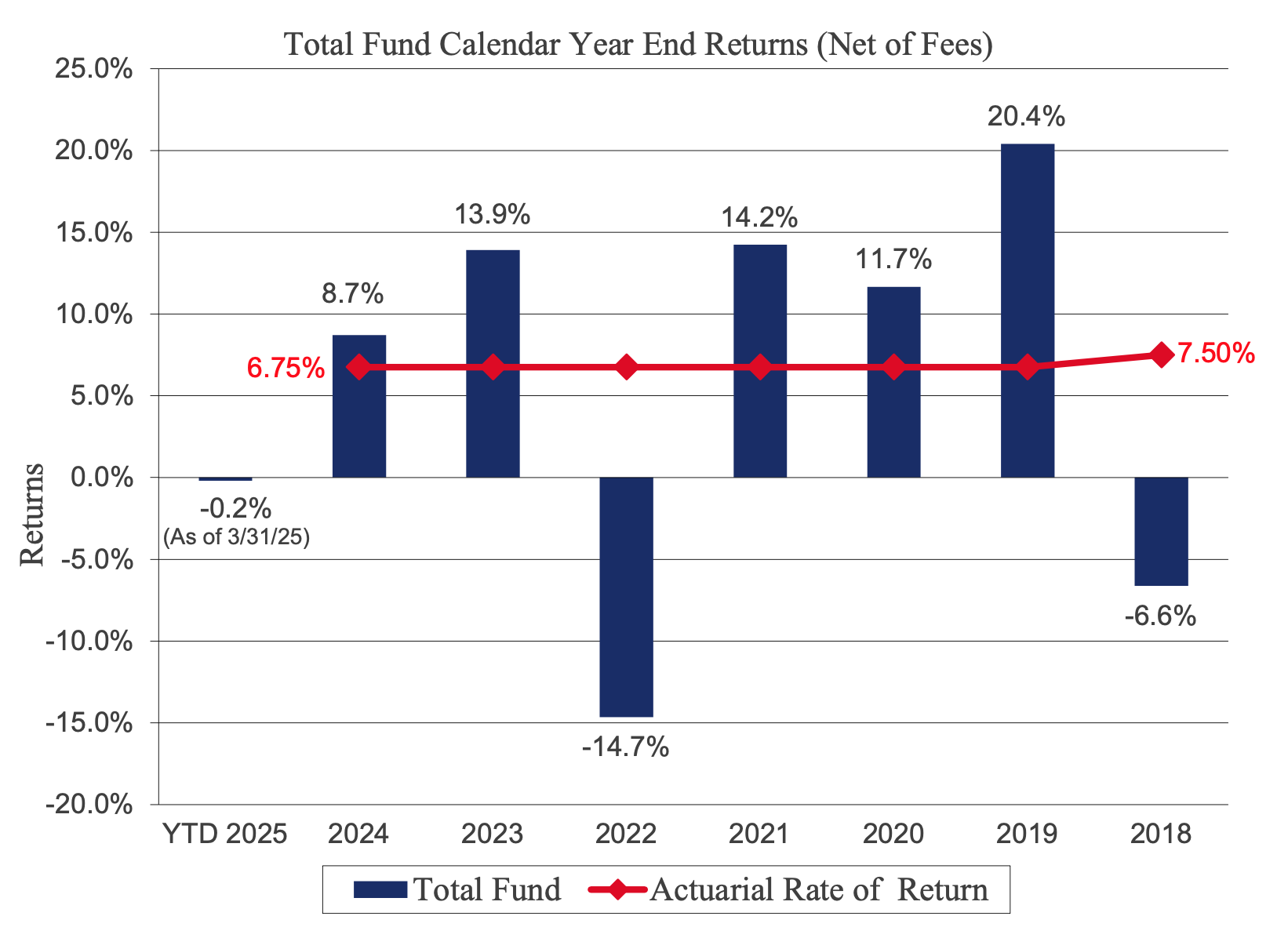

The Fund’s portfolio, as of the same period, has experienced a decline of -0.2% net of fees. While we understand and monitor short-term performance, the Fund is a long-term investor and investment results over longer periods show positive returns as illustrated in the following chart. The chart also reflects strong Fund performance versus the actuarial required rate of return, which is the assumed investment return that is used by the actuaries in calculating employer contributions. The Fund is diversified across asset classes and positioned to outperform over the long-term. Short-term underperformance is not unexpected.

The Fund is built on the foundation of a long-term investment horizon, diversification of assets, and disciplined investment policy compliance. This foundation accounts for the ups and downs of financial markets. Tools such as asset smoothing, strategic asset allocation, and periodic portfolio rebalancing help the Fund maintain stability and meet long-term obligations. While short-term market movements can draw attention, they are not a reliable measure of the Fund’s overall health or trajectory.

In addition to monitoring the investment portfolio, the Board tracks the expected employer contributions from the City, as the City contributions are vital to the long-term health of the Fund. Through April’s Board Meeting, the Fund has received $269 million of the expected $445 million in City contributions for 2025.

The Board receives regular updates on its investment portfolio from its investment consultant Callan, and remains diligent in monitoring employer contributions, and will respond to any situation that would negatively impact on the Fund’s ability to meet current obligations.

1862